4 PPP Tips on Optimizing Your Second Draw Check

Survive & Thrive

A second Paycheck Protection Program (PPP) is in the works. After the first package early in 2020, businesses that managed to wrangle a check found themselves with essentially “free money.”

So in preparation for the second PPP release, many business owners want to know how to optimize this benefit.

In a recent video interview, CEO of Simple Focus JD Graffam and Allan Branch, an entrepreneur who’s worked in software design and accounting, discussed ways to use the second round of the Paycheck Protection Program.

How to Optimize Your PPP Money

The second draw PPP loans are fairly versatile. You can use it for payroll, rent, utilities, supplier and operations costs, to name a few. As long as 60% of your loan is spent on payroll, you can use the rest of it on eligible expenses.

So where to start?

1. Don’t Rush

You may have a lot of bills piling up. Or projects you want to get started on. But don’t rush in giving your money away.

First and foremost, you should look at your cash flow and long-term goals to understand how you can best use the rest of your loan. And we mentioned earlier that there are several ways you can put that money to work.

So first, take a breather and strategize.

2. Invest in Your Workers

Your employees are the lifeblood of your company. If you don’t have pressing expenses, you should consider using some of that money towards employee bonuses or benefits. Your workers, who may be doing more than before if you had to lay off some of their colleagues, may have low morale and be overworked.

Investing in them is one way to give them a boost and show how much you appreciate their hard work.

Furthermore, the purpose of the loan is to stimulate the economy. If you give that money back to your workers, they will go out and use it.

3. Pad Your Business

If there are no urgent expenses (such as rent) you could use the rest of the loan to “pad” your business. That doesn’t mean you should stuff the remainder in your bank account. Instead, use that money to see how you can take your business to the next level.

This could mean investing in meetings, networking events, or testing marketing campaigns, or other advantages that can help you level up your business and lead to new or improved revenue streams.

4. Build Your Brand

Whenever you have a low moment at work, consider taking on clients at lesser rates or for free to build your brand and foster relationships. This can include taking on non-profit work or helping long-term clients at a reduced or pro-bono rate.

With so many things going wrong during the pandemic, you can highlight how your business is doing things right for the community. And while you won’t be getting an immediate income, it’s a great way to plan for the long-term and differentiate yourself from your competitors.

Still Stuck?

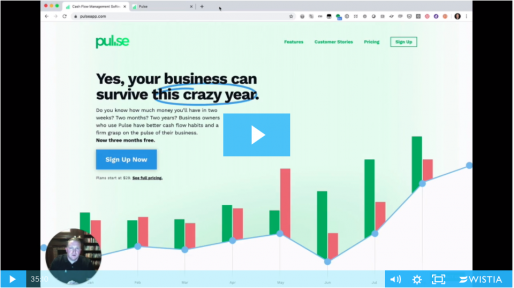

Before spending a dime of that PPP money, you really need to understand your long-term cash flow. We can help. Try out Pulse for 30 days free and start strategizing.