5 Practical Cash Flow Survival Tips for Your Business During Coronavirus

Survive & Thrive

Most small businesses have only two months or less of cash on hand for emergencies. With the unemployment rate soaring to 20% and continuing uncertainty, small and mid-sized businesses are trying to figure out how to survive.

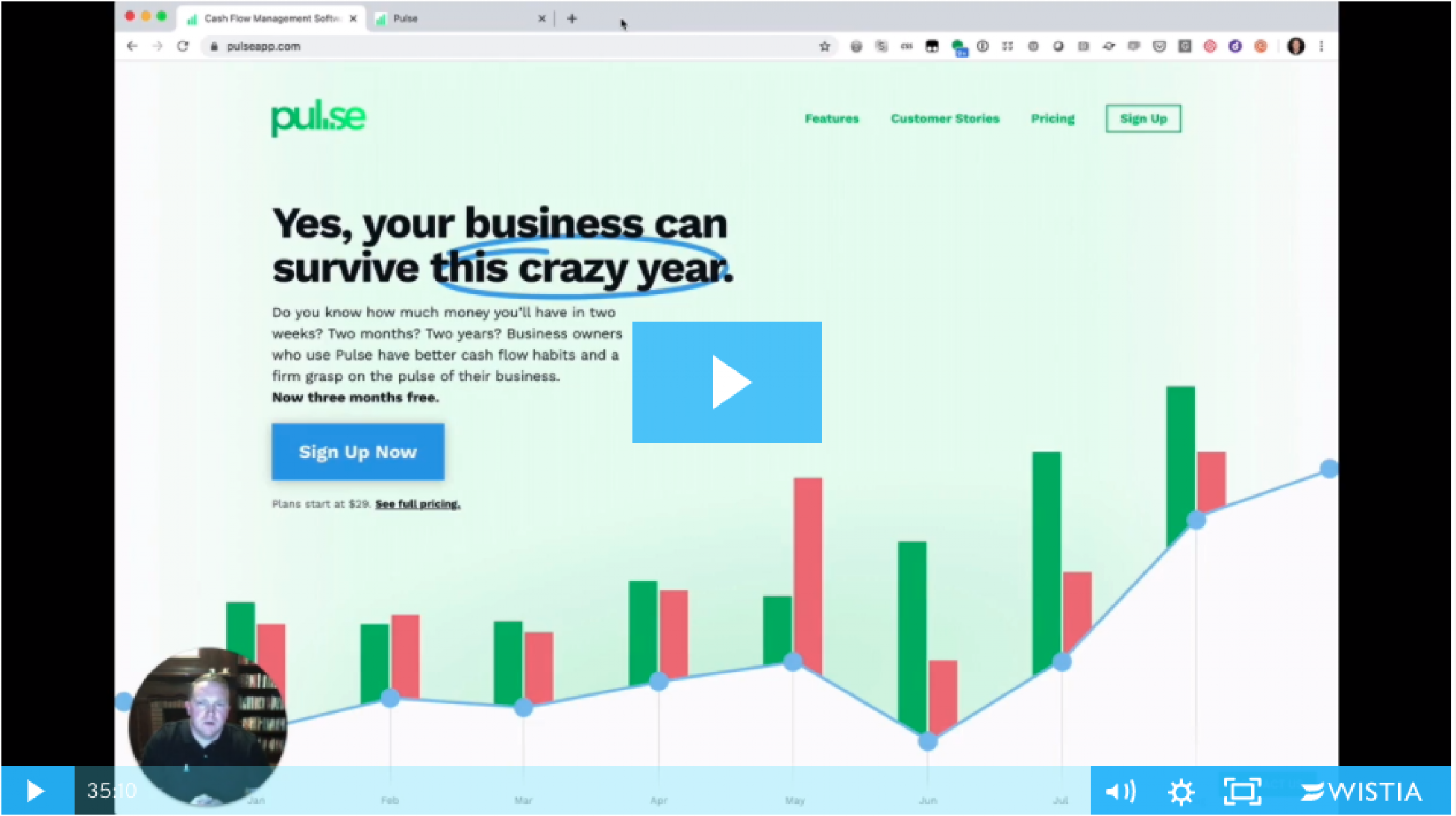

So what can you do? To answer this question, Pulse put together a free webinar to help small business owners make informed decisions and navigate challenges with confidence, especially when it comes to understanding and projecting cash flow.

“When you have a clear picture of what cash you’ll have on hand if you delay a project or furlough an employee, you’re being strategic. It’s important right now to not just throw darts and hope you survive,” explains Pulse owner JD Graffam.

Here, we’ve boiled the top tips into five practical steps you can take today.

Tip #1 - Grab cash where you can

To figure out how long your business can stay up and running, we first need to understand what we have to work with. That’s why it’s critical to hold down any and all cash before you take any other step. You need to keep what you have, collect what you can from customers, and consider any lines of credit available. It may sound self-centered to focus on locking down your money, but the longer you can stay afloat, the more likely your business is to survive.

You can keep track of your cash using a money management tool or a simple spreadsheet. To get started, we recommend listing what you have for the next 12 months.

Tip #2 - Cut expenses

The next thing to do is list your expenses and cut out whatever you can. Don’t pay any creditors or bills that aren’t immediate. If you can, put them off, see if you can pay later, or ask for a discount. Inessential expenses will differ from business to business, but most likely you will find savings somewhere in your expense sheet.

“It is such a simple thing, but anytime I’ve got a decision to make about spending money, I always default to not spending it,” says Graffam.

After you look at general expenses, you will need to evaluate and possibly lower salaries—starting with yours.

“It's really important for you ultimately to do everything you can to keep your people with you,” says Graffam. “Because without your employees, you don't have a business—and always start with your own salary first.”

Once you lower your salary, you can then proceed to cut salaries for your employees. While it isn’t an ideal scenario, a lower salary is better than no salary. If you have to let someone go, make sure to pay them what you owe. And if possible, consider offering a furlough instead of laying them off completely.

Tip #3 - Take advantage of government programs, credit, and deferments

Notice a trend here? This tip supports Tip 1—get your hands on cash and keep it for as long as possible. Now that you know what you have and have gained more time by eliminating inessential expenses, you can look at strategic loans and deferments.

For example, you may qualify and take out an SBA Paycheck Protection Program Loan, which can be forgiven if it’s spent on payroll. If you already had an SBA Serviced Disaster Loan, you can defer payments up until the end of 2020.

Apart from applying for grants or lines of credit, you can also look at deferring tax, loans, and bill payments.

“Make sure to ask about interest and penalties if possible. You may find savings where you don’t expect them,” says Graffam.

Tip #4 - Start projecting your cash flow

Once you know how much you have and how much to cut, you can begin looking at the long-term though cash flow projection. In other words, model the best and worst-case scenarios.

For example: In step one, you discovered you had enough cash to run your business for two months. After cutting expenses and lowering salaries you’ve managed to save enough capital to keep the business going for another two months—four total. Now, how can you extend that to six months? Eight?

With cash flow projection, this means taking a hard look at your client base and understanding how you can strategically move things around. For example, you may need to renegotiate planned work, delay projects, or offer discounts. You can estimate how long you can keep an employee—and if you will be able to give them a furlough or execute a direct layoff.

Apply your different cash flows—your credit, grants, and deferments—to your model to get an accurate idea of how long you have.

Projecting your cash flow will give you the confidence to know what needs to be done to get through this difficult period.

Tip #5 - Stay positive

At the end of the day, it’s critical to keep a positive mindset. Put yourself first, love your family, friends, and your pets. A pandemic is a trying time, but you have the potential to make it work for you.

As the lockdown continues, more and more uplifting stories are popping up to combat the negativity. For example, some restaurant owners who have switched to takeout-only serving hospitals and are making more than before. Others are finding new and innovative ways to market their business or mix up their services. And movements to support small business owners, like #PayToday, are bringing attention to the plight of small businesses.

Instead of dwelling on what you can’t control, it’s better to focus on what you can do at this moment —and appreciate everything you do have.

Be strategic now to thrive later

When it comes to crisis planning—whether it’s a global pandemic or a throwback to the 2008 recession, cash flow clarity is key to survival. Keeping as much cash as possible, cutting expenses, deferring payments, and strategically taking on credit can help your business stay afloat. Add cash flow projection, or modeling different scenarios, and you’ll have the confidence only real data can provide. No matter how the COVID-19 crisis challenges your business, a firm grasp on your cash flow will equip you to chart out a strategy that makes sense for your business.

Next steps

Projecting your cash flow can get complicated—hello, spreadsheets headaches!—but Pulse makes it easy. If you need clarity on your business’s financial forecast, start a free trial (we’ve temporarily extended it 3 months to support businesses during the Coronavirus).

No credit card required